Inspired Travel Group is a full-service corporate travel agency servicing clients right the way across North America. Our people first approach to travel ensures only the highest levels of personalized, attentive service.

Are you a business owner, self-employed professional or just someone who uses their personal vehicle for work-related travel in Ontario? Knowing the specific mileage rates for 2024 can help you effectively manage your travel expenses and maximize tax deductions.

This guide provides a comprehensive overview of everything you need to know about Ontario’s mileage rates for 2024, click the following link for information on the Ontario Milage Rate for 2025.

Mileage rates are amounts that taxpayers can use to calculate deductions for using a personal vehicle for business, medical or charitable purposes. These rates are designed to cover the costs associated with the operation of a vehicle, including fuel, maintenance, insurance and depreciation.

For 2024, Ontario has set the following standard mileage rates:

These rates apply from January 1, 2024, through December 31, 2024 and reflect adjustments from the previous year to accommodate for inflation and changes in vehicle operating costs.

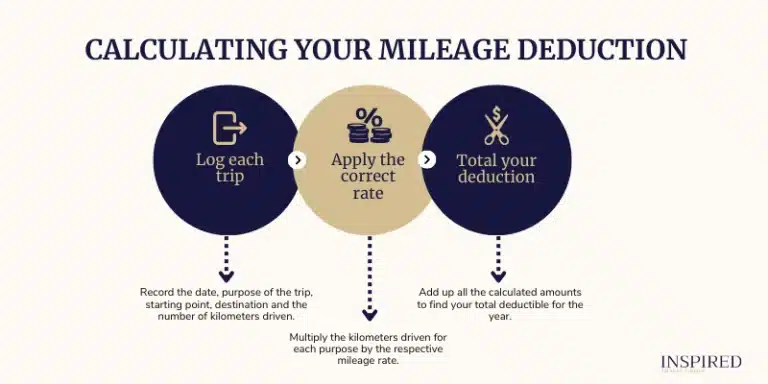

To calculate your mileage deduction, you will need to keep a detailed log of all your vehicle usage for different purposes. Here’s how you can do it:

For instance, if you drove 1,000 kilometers for business purposes, your deduction would be 1,000 km x $0.61/km = $610.

Using the standardized mileage rates simplifies the process of claiming vehicle expenses on your taxes. It eliminates the need to track every single car-related expense, making it easier for individuals who may not keep detailed receipts. Additionally, it provides a fair estimation of vehicle costs that is generally accepted by the Canada Revenue Agency (CRA).

Accurate record-keeping is crucial for claiming mileage deductions. Consider using a digital mileage tracker to automatically record your drives. Apps like MileIQ or QuickBooks Self-Employed provide automated tracking and reporting features that can help streamline your records for tax purposes.

While mileage rates can fluctuate with economic changes, such as variations in fuel prices or general inflation, forecasting future rates can help in planning your business budget effectively. Staying updated with announcements from the CRA or consulting with a tax professional can provide insights into potential rate changes.

Understanding and applying the correct mileage rates for 2024 can lead to significant savings on your tax returns. By maintaining detailed logs and using the standardized rates, you ensure compliance with CRA regulations and optimize your deductions.

Looking for comprehensive corporate travel management solutions? Inspired Travel Group is here to assist. We specialize in providing tailored travel management services that meet the unique needs of your business. From booking and managing travel arrangements to optimizing travel policies and expenses, we ensure your business travel is cost-effective and hassle-free. Contact us today for all your corporate travel needs and experience seamless travel management like never before